Insights:

The Northeast Food System Crisis

The aging of America's farming population creates an unprecedented challenge for agricultural continuity and food security, particularly in the Northeast.

The Farm Succession Crisis: By the Numbers

1

Aging Farmers

The average farmer age in the Northeast is 60.5 years. 45% of farmland is owned by farmers over 65, with over 60% expected to retire in the next decade.

2

The Succession Gap

New farmer entries are down 35% since 1990, and only 25% of farms have formal succession plans. High barrier to entry with average farm purchase cost at $1.125M.

3

Market Consolidation

Northeast farm numbers declined 8.5% (2017-2022). Corporate and out-of-state entities are increasingly acquiring retiring farmers' land.

Infrastructure Financing Gaps

Farms and food businesses in the Northeast require substantial capital for essential processing facilities, storage, and distribution infrastructure to scale operations and meet growing demand.

Processing Facility Upgrades

Many existing facilities are outdated or insufficient, requiring significant investment for modern equipment and expansion to increase capacity and efficiency.

Cold Storage & Distribution

Maintaining product quality and extending shelf life necessitates robust cold chain logistics, from farm-level storage to regional distribution hubs, which demands costly specialized infrastructure.

Equipment Financing Barriers

Acquiring new, specialized agricultural and processing equipment often faces resistance from traditional lenders due to perceived high risk and lack of industry understanding.

The Fullerfield Approach

We provide tailored financing solutions for infrastructure development, including equipment loans and facility improvement capital, with an understanding of the unique cash flow realities of the food sector.

Growth Financing Crisis

Sustainable CPG brands face a critical financing gap that constrains growth and market expansion, particularly in inventory and operational capital.

Cash Flow Cycle Strain

The 60–90 day cash conversion cycle and long retailer payment terms (up to 90 days) lock up essential working capital.

Inventory Financing Gap

Scaling requires $50K–$500K in inventory capital, which is frequently unavailable during crucial production phases.

Traditional Barriers

Conventional lenders require personal guarantees and collateral, and venture capital typically avoids CPG working capital needs.

The Fullerfield Solution

We offer inventory-backed working capital and revenue-based financing that aligns directly with CPG sales cycles, without personal guarantees.

The Market Opportunity

A significant market opportunity exists within the Northeast food system, driven by increasing consumer demand for local and sustainable products, coupled with the existing financing and infrastructure gaps.

Market Size

$1.4T

U.S. Food & Beverage Market

Overall market size

$80B

Northeast Regional Food Sales

Growing at 5% annually

$25B

Impact on Regional Economy

Economic activity from local food systems

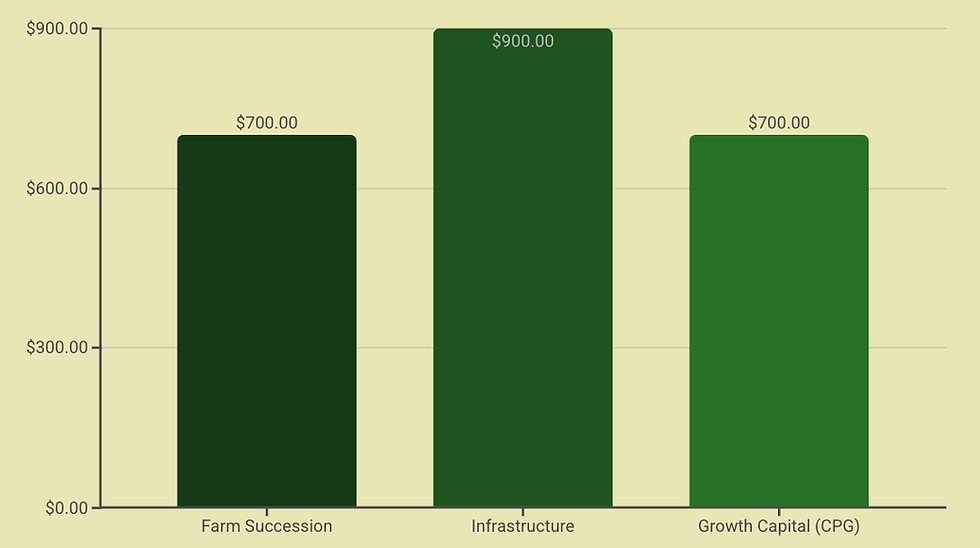

Financing Gap ($M)

The estimated financing gap across farm succession, critical infrastructure, and growth capital for CPG, amounts to over $2.3 billion in the Northeast alone, representing a substantial, untapped investment potential for specialized lenders.

Growth Drivers

Consumer Demand

Rising consumer preference for locally sourced, organic, and sustainably produced foods.

Policy Support

Government initiatives and grants supporting local food systems and resilient supply chains.

Technological Advancements

Innovations in agricultural technology improving efficiency and sustainability.